Uber Technologies, Inc. Common Stock (UBER)

77.93

+0.00 (0.00%)

NYSE · Last Trade: Feb 4th, 7:18 AM EST

Detailed Quote

| Previous Close | 77.93 |

|---|---|

| Open | - |

| Bid | 71.80 |

| Ask | 71.85 |

| Day's Range | N/A - N/A |

| 52 Week Range | 60.63 - 101.99 |

| Volume | 394,389 |

| Market Cap | 163.65B |

| PE Ratio (TTM) | 10.02 |

| EPS (TTM) | 7.8 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 20,023,930 |

Chart

About Uber Technologies, Inc. Common Stock (UBER)

Uber Technologies Inc is a leading technology company that revolutionizes urban transportation and logistics through its mobile app platform. The company connects riders with drivers for convenient ride-hailing services, while also offering a range of additional services, such as food delivery through Uber Eats and freight transportation. With a focus on innovation, Uber continually explores advancements in areas like autonomous vehicles and aerial mobility, aiming to enhance the efficiency and accessibility of transportation solutions for individuals and businesses worldwide. Read More

News & Press Releases

The semiconductor giant plays a central role in the expansion of the AI market.

Via The Motley Fool · February 4, 2026

Uber Technologies, Inc. (NYSE: UBER) today announced financial results for the quarter and full year ended December 31, 2025.

By Uber Technologies, Inc. · Via Business Wire · February 4, 2026

US stock futures higher, key stocks to watch: UBER, AMD, LLY, SMCI, GOOG. Analysts expect strong earnings from Uber and Alphabet.

Via Benzinga · February 4, 2026

Uber is scheduled to report results for its fourth fiscal quarter before the market opens on Wednesday, February 4.

Via Talk Markets · February 3, 2026

ARK doubled down on Joby after dilution-driven weakness, but lofty valuation means execution on FAA approval is the real swing factor.

Via Barchart.com · February 3, 2026

Cryptocurrencies are already seeing plenty of volatility in 2026.

Via The Motley Fool · February 3, 2026

Uber set for strong demand environment, growth in core mobility business, analysts predict ahead of Q4 earnings call.

Via Benzinga · February 3, 2026

Ride sharing and on-demand delivery platform Uber (NYSE:UBER)

will be reporting earnings this Wednesday before the bell. Here’s what to look for.

Via StockStory · February 2, 2026

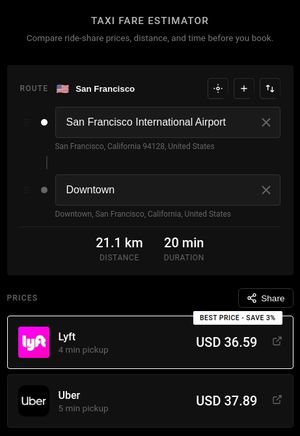

SAN FRANCISCO, CA - February 2, 2026 - Payfair (https://payfair.cash), a new rideshare price comparison platform, today announced the public launch of its free fare estimation tool that allows consumers to instantly compare Uber and Lyft prices before booking a ride.

Via AB Newswire · February 2, 2026

Uber, Nvidia, and Mercedes will all work together on a new robotaxi platform.

Via Barchart.com · February 2, 2026

As of early February 2026, the identity of Tesla, Inc. (NASDAQ: TSLA) has undergone its most radical transformation since the launch of the Model S. Following a fiscal year 2025 that saw the company’s first-ever annual decline in both revenue and profit, CEO Elon Musk has doubled down on

Via MarketMinute · February 2, 2026

Tesla (NASDAQ: TSLA) shares rose by more than 3% in early trading on Monday, February 2, 2026, as investors reacted to a fourth-quarter earnings report that managed to exceed analyst expectations despite a cooling global electric vehicle market. The stock climbed to $430.41, bolstered by a significant improvement in

Via MarketMinute · February 2, 2026

Last week we saw a plethora of important earnings results and increased market volatility. This wee should be another busy one with a lot of important companies due to report.

Via Barchart.com · February 2, 2026

Ride hailing was only the start as the company adapts to an AI-driven world.

Via The Motley Fool · February 1, 2026

The management teams at these companies are displaying a forward-thinking mentality.

Via The Motley Fool · February 1, 2026

Wisk, backed by Boeing, is pursuing autonomous eVTOLs, posing a threat to Joby and Archer.

Via The Motley Fool · January 31, 2026

Via MarketBeat · January 31, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

Via Benzinga · January 30, 2026

Wall Street is overwhelmingly bullish on the stocks in this article, with price targets suggesting significant upside potential.

However, it’s worth remembering that analysts rarely issue sell ratings, partly because their firms often seek other business from the same companies they cover.

Via StockStory · January 29, 2026

GLOBAL, Jan. 23, 2026 — KROOZ® (https://KROOZ.co | https://KROOZDriver.com), a global rideshare, technology, and transportation network company (TNC), today announced the continued worldwide expansion of its driver-owned mobility platform, now operating across 118 countries and providing rideshare transportation, cuisine and food delivery, and hot-shot package delivery services.

Via GlobePRwire · January 29, 2026

Netflix may be forced to offer all cash for WBD if the cable assets being spun off don't have the value Netflix thought they did. But is that something Netflix will do, and what are the risks?

Via The Motley Fool · January 29, 2026

Tesla shares aren't cheap, but the stock is worth a look by investors aiming to potentially compound $500.

Via The Motley Fool · January 29, 2026

1-800-FLOWERS.COM (FLWS) Earnings Transcript

Via The Motley Fool · January 29, 2026