Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

The Indian Rupee is trading firmly against the US Dollar near 90.47, buoyed by a landmark trade deal announced by President Trump. The agreement, which caps reciprocal tariffs at 18%, has significantly boosted investor sentiment...

Via Talk Markets · February 4, 2026

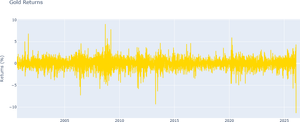

Gold climbs above $5,000 as data delays, Fed uncertainty, and Middle East tensions drive safe-haven demand. Hawkish policy signals and geopolitical risks provide a strong backdrop for gold’s continued bullish momentum.

Via Talk Markets · February 4, 2026

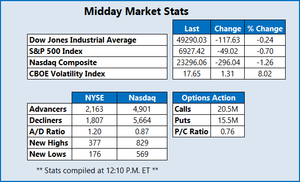

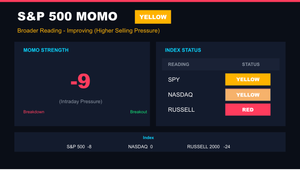

Market indexes caved mid-afternoon on a combination rotation out of high-growth tech (of which AI stocks looked to be riding up again before getting slapped down Friday) and a tenuous feel regarding what’s around the corner for the economy.

Via Talk Markets · February 3, 2026

In this video, I break down the technical implications of today’s move, go over the key levels each ETF is bouncing from, and what it means for traders heading into the next few sessions.

Via Talk Markets · February 3, 2026

You don’t have to buy tech stocks to see great returns. Lesser-discussed companies have built consistent, dependable growth by doing the ‘simple’ things exceptionally well.

Via Talk Markets · February 3, 2026

While the U.S. is not currently in a recession, the economy is struggling to avoid a downturn.

Via Talk Markets · February 3, 2026

Earnings season risk is defined not by volatility, but by the

Via Talk Markets · February 3, 2026

Cotton was lower along with many other commodities. Trends started to turn down on the daily and weekly charts.

Via Talk Markets · February 3, 2026

Oil prices received a boost as tensions between the US and Iran resurface. For now, though, the latest escalation isn’t derailing planned talks

Via Talk Markets · February 3, 2026

Wednesday's market anticipates massive earnings from Alphabet and Amazon, alongside a volatility

Via Talk Markets · February 3, 2026

In this video, Ira Epstein discusses the unexpected downturn in the financial markets that occurred on February 3, 2026, triggered by Anthropic's announcement of a new legal software module that disrupted tech stocks.

Via Talk Markets · February 3, 2026

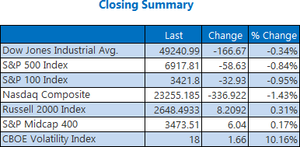

Stocks fell sharply, even though the S&P 500 finished the day down just 85 basis points. Technology and software stocks were hit the hardest, pushing the Nasdaq 100 down more than 1.5% and dragging the XLK ETF lower by over 2%.

Via Talk Markets · February 3, 2026

Gold is staging a strong recovery toward $5,000, while Bitcoin remains under pressure after a significant breakdown. The divergence highlights a shift in speculative flows as markets react to new Federal Reserve leadership and policy shifts.

Via Talk Markets · February 3, 2026

The rebound is purely technical, nothing is really happening in the USD Index that would justify it.

Via Talk Markets · February 3, 2026

Gold and silver have recovered part of their recent losses following one of the sharpest corrections seen in precious metals in over a decade

Via Talk Markets · February 3, 2026

Silver and gold were annihilated last week. Silver dropped over 35% while gold plunged 17%.

Via Talk Markets · February 3, 2026

Gold price (XAU/USD) trades in positive territory near $4,985 during the early Asian session on Wednesday.

Via Talk Markets · February 3, 2026

The retest strategy is built on patience. Instead of chasing the surge, you let the breakout happen and allow the excitement to cool off. Then you wait for price to pull back to the level it just broke.

Via Talk Markets · February 3, 2026

The Pound Sterling traded in a narrow range against the US Dollar on Tuesday, edging modestly higher to near 1.3700 as markets adopted a cautious stance ahead of the BoE first policy decision of 2026.

Via Talk Markets · February 3, 2026

The recent market rotation toward small caps and value has also extended toward sectors, with Technology, which was one of the top-performing sectors of 2025, turning from a leader into a laggard in January.

Via Talk Markets · February 3, 2026

Walmart has had an amazing run so far during the 2020s, with its market cap rising from a little more than $300 billion in early 2020 to more than $1 trillion today.

Via Talk Markets · February 3, 2026

Despite strength in defensive sectors and select earnings winners, a deepening selloff in enterprise software stocks and a sharp decline in PayPal Holdings Inc. weighed heavily on sentiment.

Via Talk Markets · February 3, 2026

Via Talk Markets · February 3, 2026

The gold market continues to be one that a lot of people will be watching closely.

Via Talk Markets · February 3, 2026

Tesla Inc. Q4 earnings, released on Jan. 28, were strong, but its near-term put options still have high yields.

Via Talk Markets · February 3, 2026

When investors become complacent, it usually means that the good times are about to come to an end. This is the situation we are in today.

Via Talk Markets · February 3, 2026

Ethereum price trades near $2,350 as whale selling caps rallies while oversold RSI signals hint at short-term volatility and support tests.

Via Talk Markets · February 3, 2026

In a sharp reversal, the Dow pulled back from record highs on Tuesday to settle more than 150 points lower. The S&P 500 finished firmly in the red as well, while the Nasdaq dropped 336 points as investors rotated out of tech.

Via Talk Markets · February 3, 2026

The Canadian Dollar found fresh footing on Tuesday, keeping USD/CAD bids below 1.3700.

Via Talk Markets · February 3, 2026

The Pound Sterling trades cautiously ahead of the BoE policy announcement on Thursday.

Via Talk Markets · February 3, 2026

The dichotomy between aggregate indicators and the labor market measures remains, in both sets of indicators.

Via Talk Markets · February 3, 2026

The wildfire is spreading. After watching Silver, Gold, and Bitcoin crater, the

Via Talk Markets · February 3, 2026

The extent to which consumption outpaces wages is likely to increase as the bubble grows further. That will make the recession following the collapse worse and the adjustment process longer.

Via Talk Markets · February 3, 2026

The crypto panic from the weekend is now bleeding into equities. The S&P 500 wiped out all of yesterday's gains. Tech is leading the selloff.

Via Talk Markets · February 3, 2026

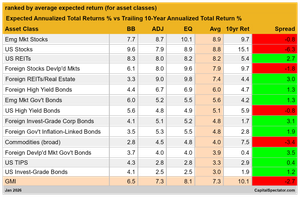

U.S. and international markets are trading at historically wide valuation gaps, setting the stage for potential foreign market outperformance in the years ahead.

Via Talk Markets · February 3, 2026

Uber is scheduled to report results for its fourth fiscal quarter before the market opens on Wednesday, February 4.

Via Talk Markets · February 3, 2026

Here’s why it changes nothing about the long-term setup—and may have just made it better.

Via Talk Markets · February 3, 2026

The immediate trigger for the rout appears to be a replay of concerns first aired after Broadcom’s December guidance.

Via Talk Markets · February 3, 2026

Palantir delivered a huge earnings beat — not just on revenue and EPS, but with forward guidance that far exceeded Wall Street’s expectations.

Via Talk Markets · February 3, 2026

HOOD has taken a beating in 2026, down 20% year-to-date following a sharp 10% drop yesterday on ongoing weakness in the cryptocurrency markets.

Via Talk Markets · February 3, 2026

Silver rebounds sharply on Tuesday and trades around $85.30 , up roughly 6.50% on the day at the time of writing.

Via Talk Markets · February 3, 2026

Novo Nordisk stock plunged approximately 15% after the Danish pharmaceutical giant posted better-than-expected 2025 results but delivered a weak 2026 outlook.

Via Talk Markets · February 3, 2026

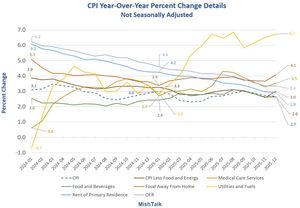

At Davos, Trump proclaimed he “defeated inflation”.

Via Talk Markets · February 3, 2026

Home price deflation is underway in many high-population centers in Canada and America.

Via Talk Markets · February 3, 2026

Today has been another volatile session for gold and silver prices, with the former up over 7% as of this writing and the latter up well over 15% versus yesterday's close.

Via Talk Markets · February 3, 2026

Valued at $1.95 billion, Cimpress is an online supplier of high-quality graphic design services and customized printed products.

Via Talk Markets · February 3, 2026

The S&P World Ex-U.S. Momentum Index’s 2025 results highlight the recent strength of the momentum factor across developed markets internationally.

Via Talk Markets · February 3, 2026

The Dow Jones Industrial Average first crossed the 40,000 milestone in mid-2024, yet barely 18 months later, the index has notched another record closing high and is now knocking on the door of 50,000.

Via Talk Markets · February 3, 2026

Its gone red since I drew up this chart, but still a nice series of higher highs and higher lows in place. But some reservation about a bigger pullback.

Via Talk Markets · February 3, 2026

The increase in futures flows comes after XRP’s price rebounded from a low of $1.52 to above $1.6.

Via Talk Markets · February 3, 2026

After a

Via Talk Markets · February 3, 2026

Not only did the warm up crush natural gas but also the overall commodity sell off and the fact that reports in Europe say that they’re back to buying Russian natural gas.

Via Talk Markets · February 3, 2026

London's FTSE 100 index retreated after reaching a record high on Tuesday.

Via Talk Markets · February 3, 2026

The Dow Jones Industrial Average notched a fresh record right out of the gate but has since cooled, with the blue-chip index now down triple digits.

Via Talk Markets · February 3, 2026

According to RWE, the contracted capacity is expected to generate enough clean electricity to supply the equivalent of more than 139,000 German households annually.

Via Talk Markets · February 3, 2026

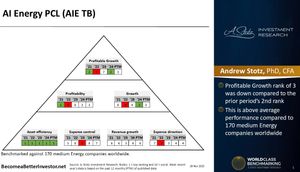

AI Energy Public Company Limited is a Thai manufacturer and distributor of alternative energy and edible oil.

Via Talk Markets · February 3, 2026

When the price of gold plunged on Friday, Chinese investors lined up at the only Singapore bank selling gold products to retail customers to take advantage of the dip.

Via Talk Markets · February 3, 2026

The long-term return forecast for the Global Market Index held steady in January at 7%-plus while the benchmark’s trailing 10-year shot higher through last month, rising above 10%.

Via Talk Markets · February 3, 2026

Walmart shares rose after the company’s market value crossed the $1 trillion mark on February 3, 2026, making it one of only ten U.S. companies to achieve this milestone.

Via Talk Markets · February 3, 2026

Although the benchmark indices opened higher, they traded positively throughout the session and ultimately closed green.

Via Talk Markets · February 3, 2026

FUIZF has declared and paid variable annual dividends since August 2018. The August 2025 Q dividend of $1.38 suggests a $1.38 annual dividend for the coming year, which is to be declared in June.

Via Talk Markets · February 3, 2026

Gold rebounds from key trendline support after a steep correction. Policy uncertainty, Dollar weakness, and delayed data releases are shaping near-term price action.

Via Talk Markets · February 3, 2026

The ECB is widely expected to keep rates unchanged after its monetary policy meeting on Thursday, the first decision of the new year.

Via Talk Markets · February 3, 2026

After some modest overnight US Dollar softness, the greenback has edged back slightly above last night’s levels, while the standout mover has been the Australian Dollar following a surprise hike from the Reserve Bank of Australia.

Via Talk Markets · February 3, 2026

PayPal stock tumbled more than 16% in premarket trading after reporting fourth-quarter earnings and revenue below expectations, issuing lackluster 2026 profit guidance, and replacing CEO Alex Chriss.

Via Talk Markets · February 3, 2026

Dividend paying stocks in the U.S. stock market got off to an unexpectedly strong start in January 2026.

Via Talk Markets · February 3, 2026

Friday, January 30, 2026, will go down as a landmark date in the gold and silver markets.

Via Talk Markets · February 3, 2026

PayPal Holdings shares are tumbling 14% in premarket trading following the release of its fourth-quarter 2025 earnings report, which fell short of analyst expectations on profits.

Via Talk Markets · February 3, 2026

Tighter credit conditions for businesses and stagnant demand for loans related to fixed investment indicate that the expected improvement in eurozone investment is still primarily driven by public spending.

Via Talk Markets · February 3, 2026

Last week's jitters look short-lived on metals... macro and earnings dominate.

Via Talk Markets · February 3, 2026

The sense of anxiety that hung over the capital markets eased today.

Via Talk Markets · February 3, 2026

EUR/USD steadied at 1.1803 on Tuesday after a strong two-day fall. Support came from strong US macro data and the Fed's revised monetary policy expectations.

Via Talk Markets · February 3, 2026

Debunking rumors and providing the facts as reported regarding the Tesla, XAI, SpaceX investment, merger, or other.

Via Talk Markets · February 3, 2026

Merck, PepsiCo, and Eaton Corporation have unveiled their earnings for the fourth quarter of 2025, showcasing their performance against market expectations.

Via Talk Markets · February 3, 2026

The market closed with an elongated price structure, recovering much of the previous week’s decline with strong bullish momentum.

Via Talk Markets · February 3, 2026