Direxion Daily S&P 500 Bull 3X Shares (SPXL)

220.74

+0.00 (0.00%)

NYSE · Last Trade: Feb 19th, 5:09 AM EST

These ETFs take on significant debt to fund their massive gains.

Via The Motley Fool · February 16, 2026

These popular ETFs are double-edged swords.

Via The Motley Fool · February 11, 2026

Both Direxion Daily S&P 500 Bull 3X Shares and ProShares Ultra QQQ both magnify daily moves, but they magnify very different parts of the market. This ETF comparison explains why that distinction matters especially when volatility rises.

Via The Motley Fool · February 9, 2026

Explore how each fund’s sector focus and fee structure shape its appeal for traders seeking leveraged ETF exposure.

Via The Motley Fool · February 3, 2026

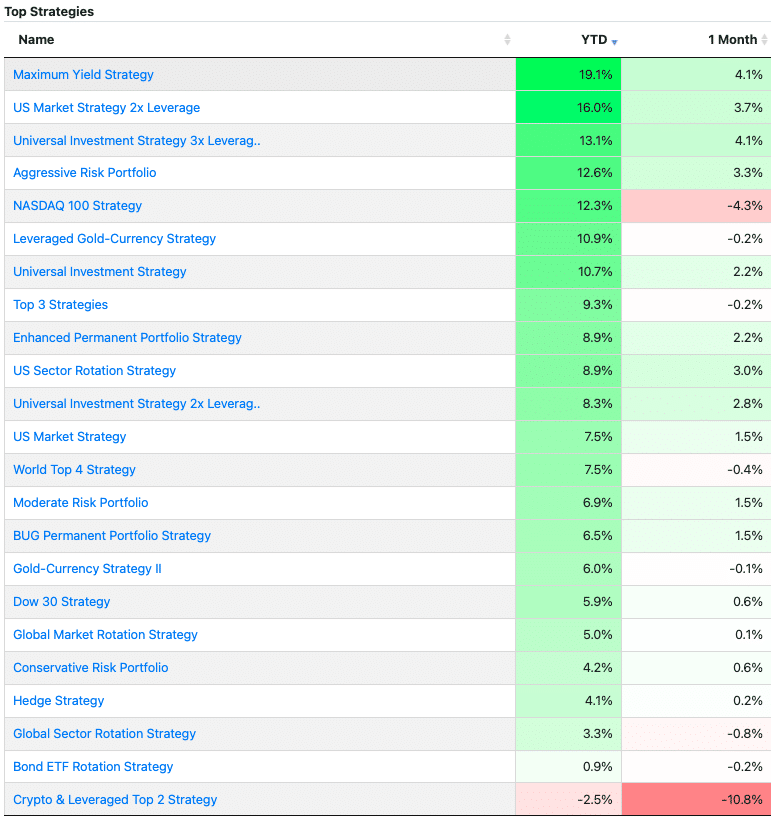

Strategy returns year-to-date as well as the monthly returns.

Via Talk Markets · July 2, 2024

Explore how sector focus and risk profiles set these two popular leveraged ETFs apart for tactical investors.

Via The Motley Fool · December 27, 2025

Explore how sector concentration and volatility set these two leveraged ETFs apart for traders seeking different risk profiles.

Via The Motley Fool · December 21, 2025

Explore how sector focus and holdings concentration set these leveraged ETFs apart for risk-aware traders.

Via The Motley Fool · December 21, 2025

Explore how differences in leverage, risk, and cost between SPXL and SSO can impact your approach to S&P 500 trading strategies.

Via The Motley Fool · December 20, 2025

QLD and SPXL Offer Distinct Leverage for Growth Investors

Via The Motley Fool · November 8, 2025

SPXL and TQQQ both offer daily 3x leveraged exposure, but SPXL focuses on the S&P 500 while TQQQ targets the tech-heavy Nasdaq-100, leading to deeper drawdowns for TQQQ.

Via The Motley Fool · November 5, 2025

TQQQ and SPXL Compare Tech Focus Versus Broad Market

Via The Motley Fool · November 3, 2025

Leveraged ETFs see a 74% inflow as investor risk appetite hits a multi-year high despite Trump induced tariff lows from April.

Via Benzinga · October 2, 2025

ProShares launches URSP, a 2x leveraged S&P 500 Equal Weight ETF, offering investors big returns without Big Tech concentration risk.

Via Benzinga · August 28, 2025

This ETF is trying to beat the market on a daily basis.

Via The Motley Fool · June 25, 2025

ETF expert Mo Sparks joins Direxion as Chief Product Officer, signaling a focus on innovation in trading. Sparks brings a wealth of experience and a vision for product expansion.

Via Benzinga · April 1, 2025

As risk-taking builds and is rewarded by higher prices, risk-taking morphs into more extreme speculation. For example, the surge of capital into 3x Leveraged S&P 500 ETFs has been remarkable.

Via Talk Markets · November 30, 2024

For investors expecting markets to continue to rise into the new year and administration, broad-based leveraged funds offer short-term potential.

Via MarketBeat · November 25, 2024

Via Benzinga · November 20, 2024

The SPDR S&P 500 (NYSE: SPY) reached a new all-time high of $526.80 on Wednesday after the Consumer Price Index (CPI) showed inflation pressures eased in April.

Via Benzinga · May 15, 2024

The SPDR S&P 500 (NYSE: SPY) was falling about 0.25% lower Wednesday ahead of the Federal Reserve’s decision on interest rates.

Via Benzinga · May 1, 2024

The SPDR S&P 500 (NYSE: SPY) was rising about 0.3% Wednesday amid persistent optimism that the Federal Reserve will cut intere

Via Benzinga · April 3, 2024

Via Talk Markets · March 26, 2024

Although inflation fears cloud the SPDR S&P 500 ETF Trust, unless hard evidence states otherwise, the SPY ETF is a long trade.

Via InvestorPlace · February 29, 2024

The S&P 500 breached the 5000 mark Friday after flirting with the record-breaking level on Thursday, buoyed by increasing positive sentiment that the Federal Reserve will apply six rate cuts this year.

Via Benzinga · February 9, 2024