Latest News

SoundHound could be a big rebound winner in 2026.

Via The Motley Fool · February 3, 2026

Sonos (SONO) Q1 2026 Earnings Call Transcript

Via The Motley Fool · February 3, 2026

However, both the company’s fourth earnings and revenue numbers beat Wall Street expectations.

Via Stocktwits · February 3, 2026

Via Benzinga · February 3, 2026

Today, Feb. 3, 2026, Walmart’s $1 trillion milestone stands out as rising bond yields and tech weakness drag major U.S. indexes lower.

Via The Motley Fool · February 3, 2026

Movers and shakers in today's after-hours session for S&P500 stocks?chartmill.com

Via Chartmill · February 3, 2026

Telecommunications infrastructure company Lumen Technologies (NYSE:LUMN) reported Q1 CY2026 results exceeding the market’s revenue expectations, but sales fell by 4.4% year on year to $3.04 billion. Its GAAP profit of $0.23 per share was significantly above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Skyworks SWKS Q1 2026 Earnings Call Transcript

Via The Motley Fool · February 3, 2026

Despite strength in defensive sectors and select earnings winners, a deepening selloff in enterprise software stocks and a sharp decline in PayPal Holdings Inc. weighed heavily on sentiment.

Via Talk Markets · February 3, 2026

Via Benzinga · February 3, 2026

Via Benzinga · February 3, 2026

Via Benzinga · February 3, 2026

Even if the clock is ticking down, you might still have some good options.

Via The Motley Fool · February 3, 2026

Aytu BioPharma AYTU Q2 2026 Earnings Transcript

Via The Motley Fool · February 3, 2026

Engineering and automation solutions company Emerson (NYSE:EMR) met Wall Streets revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $4.35 billion. Its non-GAAP profit of $1.46 per share was 3.4% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Gaxos stock soars as the company secures a new agreement with Amazon Web Services. But several underlying risks caution against chasing the rally in GXAI shares.

Via Barchart.com · February 3, 2026

Property and casualty insurer The Hanover Insurance Group (NYSE:THG) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $1.67 billion. Its GAAP profit of $5.47 per share was 3.6% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Tesla Inc. Q4 earnings, released on Jan. 28, were strong, but its near-term put options still have high yields.

Via Talk Markets · February 3, 2026

Via Benzinga · February 3, 2026

Here's a detailed look inside the Q2 earnings report from SMCI.

Via Benzinga · February 3, 2026

Financial services giant Prudential Financial (NYSE:PRU) met Wall Streets revenue expectations in Q4 CY2025, with sales up 11.6% year on year to $14.52 billion. Its non-GAAP profit of $3.30 per share was 1.9% below analysts’ consensus estimates.

Via StockStory · February 3, 2026

Investors dumped technology stocks as they move to safer assets like Gold and Silver that rose today.

Via Stocktwits · February 3, 2026

Digital Turbine APPS Q3 2026 Earnings Transcript

Via The Motley Fool · February 3, 2026

Match Group shares are rising in Tuesday's after-hours session after the company reports better-than-expected results for the fourth quarter.

Via Benzinga · February 3, 2026

When investors become complacent, it usually means that the good times are about to come to an end. This is the situation we are in today.

Via Talk Markets · February 3, 2026

Insurance holding company American Financial Group (NYSE:AFG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 1.8% year on year to $2.06 billion. Its non-GAAP profit of $3.65 per share was 10.1% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Measurement equipment distributor Transcat (NASDAQ:TRNS) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 25.6% year on year to $83.86 million. Its non-GAAP profit of $0.26 per share was 17.5% below analysts’ consensus estimates.

Via StockStory · February 3, 2026

Here's a look inside the Q3 earnings report from Take-Two Interactive.

Via Benzinga · February 3, 2026

Water analytics and treatment company Veralto (NYSE:VLTO) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.8% year on year to $1.40 billion. Its non-GAAP profit of $1.04 per share was 6% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Ethereum price trades near $2,350 as whale selling caps rallies while oversold RSI signals hint at short-term volatility and support tests.

Via Talk Markets · February 3, 2026

This telecom provider delivers fiber, cloud, and security services to businesses and consumers across U.S. and international markets.

Via The Motley Fool · February 3, 2026

The company's focus on AI-ready data centers helped it grow fiscal second-quarter revenue by 250%.

Via The Motley Fool · February 3, 2026

Novo Nordisk stock sank as management forecasts decelerating growth in 2026. But should you treat this selloff in NVO shares as a buying opportunity? Let’s find out.

Via Barchart.com · February 3, 2026

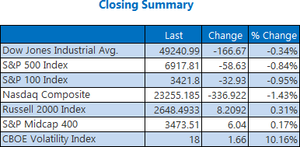

In a sharp reversal, the Dow pulled back from record highs on Tuesday to settle more than 150 points lower. The S&P 500 finished firmly in the red as well, while the Nasdaq dropped 336 points as investors rotated out of tech.

Via Talk Markets · February 3, 2026

Via Benzinga · February 3, 2026

Asset management firm Artisan Partners (NYSE:APAM) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 13% year on year to $335.5 million. Its non-GAAP profit of $1.26 per share was 15.9% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Prelude Therapeutics said on Tuesday that the FDA gave clearances to proceed with early-stage trials for its experimental drug PRT12396.

Via Stocktwits · February 3, 2026

Mortgage insurance provider Enact Holdings (NASDAQ:ACT) fell short of the markets revenue expectations in Q4 CY2025 as sales only rose 1.2% year on year to $312.7 million. Its non-GAAP profit of $1.23 per share was 11.9% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Financial technology provider Jack Henry & Associates (NASDAQ:JKHY) announced better-than-expected revenue in Q4 CY2025, with sales up 7.9% year on year to $619.3 million. The company expects the full year’s revenue to be around $2.52 billion, close to analysts’ estimates. Its GAAP profit of $1.72 per share was 20% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

SMCI reported net sales of $12.7 billion compared to $5.7 billion in the same period year-ago.

Via Stocktwits · February 3, 2026

Private equity stocks plunged alongside software names as analysts warn of deep credit risks tied to overexposure in tech-driven buyouts.

Via Benzinga · February 3, 2026

Landscaping service company BrightView (NYSE:BV) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 2.6% year on year to $614.7 million. The company expects the full year’s revenue to be around $2.7 billion, close to analysts’ estimates. Its non-GAAP loss of $0.01 per share was $0.02 below analysts’ consensus estimates.

Via StockStory · February 3, 2026

Outerwear manufacturer Columbia Sportswear (NASDAQ:COLM) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 2.4% year on year to $1.07 billion. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $753 million was less impressive, coming in 4% below expectations. Its GAAP profit of $1.73 per share was 43% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

New leadership at the company could soon begin to make some big moves.

Via The Motley Fool · February 3, 2026

Electrical energy control systems manufacturer Powell (NYSE:POWL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 4% year on year to $251.2 million. Its GAAP profit of $3.40 per share was 16.6% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

Server solutions provider Super Micro (NASDAQ:SMCI) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 123% year on year to $12.68 billion. On top of that, next quarter’s revenue guidance ($12.3 billion at the midpoint) was surprisingly good and 20.5% above what analysts were expecting. Its non-GAAP profit of $0.69 per share was 41.4% above analysts’ consensus estimates.

Via StockStory · February 3, 2026

nLIGHT shares are getting hit in after-hours trading on Tuesday after the company announces a proposed public offering.

Via Benzinga · February 3, 2026

Via Benzinga · February 3, 2026