UnitedHealth Group (UNH)

284.18

+0.00 (0.00%)

NYSE · Last Trade: Feb 4th, 8:07 AM EST

Healthcare distributor and services company Cardinal Health (NYSE:CAH)

will be reporting results this Thursday before the bell. Here’s what to expect.

Via StockStory · February 3, 2026

Healthcare insurance company Molina Healthcare (NYSE:MOH)

will be reporting earnings this Thursday after market close. Here’s what you need to know.

Via StockStory · February 3, 2026

Health insurance company Cigna (NYSE:CI)

will be reporting results this Thursday before market hours. Here’s what to look for.

Via StockStory · February 3, 2026

UnitedHealth stock has lost close to half of its value within just the past 12 months.

Via The Motley Fool · February 3, 2026

These Buffett stocks could easily beat the market over the next 12 months.

Via The Motley Fool · February 3, 2026

Trump's Medicare rate cap and a new "radical" PBM transparency rule hit UnitedHealth, CVS, and Humana. See why health stocks are tumbling.

Via Benzinga · February 3, 2026

UnitedHealth’s fourth quarter results were met with a significant negative market reaction, as management highlighted ongoing challenges in its Medicare Advantage and Medicaid businesses. CEO Stephen Hemsley described 2025 as a year of “critical self-examination,” emphasizing actions to rightsize membership, reprioritize margin over volume, and address operational inconsistencies—particularly within OptumHealth. Both Hemsley and UnitedHealthcare CEO Timothy Noel pointed to elevated medical cost trends and competitive pressures in Medicare Advantage as key drivers of membership losses and compressed operating margins. Management acknowledged that recent restructuring actions, including divesting non-core assets and workforce reductions, were necessary to establish a stronger foundation for future performance.

Via StockStory · February 3, 2026

Healthcare distributor and services company McKesson (NYSE:MCK)

will be announcing earnings results this Wednesday after the bell. Here’s what to expect.

Via StockStory · February 2, 2026

Healthcare distributor Cencora (NYSE:COR)

will be reporting results this Wednesday before market open. Here’s what to look for.

Via StockStory · February 2, 2026

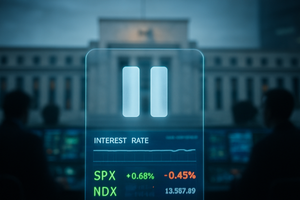

In a move that caught Wall Street's aggressive easing bulls off guard, the Federal Reserve maintained its benchmark interest rate at 3.5% to 3.75% during its January 2026 meeting, signaling a stark departure from the rapid-fire cuts seen in late 2025. Federal Reserve Chair Jerome Powell, in one

Via MarketMinute · February 2, 2026

Ten large-cap stocks posted steep weekly losses, driven by analyst downgrades, leadership headlines, and sector pressure across healthcare, tech, and precious metals.

Via Benzinga · February 1, 2026

Dialysis provider DaVita Inc. (NYSE:DVA)

will be reporting earnings this Monday after the bell. Here’s what you need to know.

Via StockStory · January 31, 2026

Retail investors talked up five hot stocks this week (Jan. 26 to Jan. 30) on X and Reddit's r/WallStreetBets: MSFT, SNDK, META, AAPL, UNH

Via Benzinga · January 31, 2026

Benzinga examined the prospects for many investors' favorite stocks over the last week — here's a look at some of our top stories.

Via Benzinga · January 31, 2026

MarketBeat Week in Review – 01/26 - 01/30marketbeat.com

Via MarketBeat · January 31, 2026

UNH stock is facing significant risk due to the Trump administration's focus on the health insurance sector.

Via Barchart.com · January 30, 2026

In a historic display of market resilience and technological optimism, the S&P 500 index officially crossed the 7,000-point threshold on January 28, 2026. This monumental achievement marks a new era for Wall Street, coming just fourteen months after the index first touched 6,000 in late 2024. The

Via MarketMinute · January 30, 2026

In 2026, five comeback stocks are expected to rise with Novo Nordisk leading the pack after receiving FDA approval for its oral GLP-1 treatment and UnitedHealth Group negotiating with the Trump administration for favorable Medicare rates.

Via Benzinga · January 30, 2026

The key indexes are still near highs, but software and precious metals took hits.

Via Investor's Business Daily · January 30, 2026

The Federal Reserve concluded its first policy meeting of the year on January 28, 2026, electing to maintain the federal funds rate at its current target range of 3.50% to 3.75%. This decision marks a "strategic pause" in the central bank's easing cycle, following three consecutive rate reductions

Via MarketMinute · January 30, 2026

Humana's Value Score hits 86.97 as a 26% YTD drop and Trump's Medicare proposal create a high-value entry point despite sector headwinds.

Via Benzinga · January 30, 2026

In a move that signaled a shift from aggressive easing to a strategic "wait-and-see" approach, the Federal Open Market Committee (FOMC) concluded its two-day policy meeting on January 28, 2026, by voting to maintain the federal funds rate at a target range of 3.50% to 3.75%. The decision

Via MarketMinute · January 29, 2026

Tuesday's sell-off in UnitedHealth Group's stock was arguably overdone.

Via The Motley Fool · January 29, 2026

In a stunning display of economic resilience, the United States economy has entered 2026 by shattering expectations and effectively silencing critics of a potential recession. Despite a historic 43-day federal government shutdown that delayed official reporting, a flurry of private sector data and the Atlanta Fed’s GDPNow forecast—currently

Via MarketMinute · January 28, 2026

As the first month of 2026 draws to a close, a wave of optimism is sweeping through the equity markets, fueled by a rare alignment of fiscal stimulus, aggressive deregulation, and a structural shift in corporate productivity. Major financial institutions have revised their year-end targets for the S&P 500,

Via MarketMinute · January 28, 2026