Apple (AAPL)

269.48

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 4th, 6:56 AM EST

Detailed Quote

| Previous Close | 269.48 |

|---|---|

| Open | - |

| Bid | 270.49 |

| Ask | 271.00 |

| Day's Range | N/A - N/A |

| 52 Week Range | 169.21 - 288.62 |

| Volume | 57,740 |

| Market Cap | 4.45T |

| PE Ratio (TTM) | 34.11 |

| EPS (TTM) | 7.9 |

| Dividend & Yield | 1.040 (0.39%) |

| 1 Month Average Volume | 54,280,569 |

Chart

About Apple (AAPL)

Apple is a leading technology company known for designing, manufacturing, and marketing a range of innovative consumer electronics, software, and services. Its flagship products include the iPhone, iPad, and Mac computers, which are widely recognized for their cutting-edge technology and user-friendly interfaces. In addition to hardware, Apple offers a suite of software applications, operating systems, and digital services such as the App Store, iCloud, and Apple Music. The company is also committed to sustainability and privacy, integrating these principles into its products and operations. With a focus on premium quality and seamless integration across its devices, Apple has established a loyal customer base worldwide. Read More

News & Press Releases

The stock has averaged annual gains of nearly 14% over the past decade.

Via The Motley Fool · February 4, 2026

Apple hits a record 69% U.S. market share in Q4 2025! Meanwhile, Motorola becomes the new king of budget phones under $300.

Via Benzinga · February 4, 2026

Analysts expect sales at Google Cloud to rise 35% in the December quarter.

Via Stocktwits · February 4, 2026

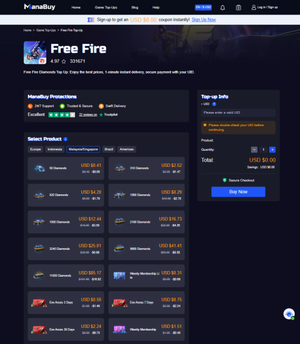

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Via Binary News Network · February 4, 2026

Microsoft has gotten torched over the last six months - since August 2025, its stock price has dropped 23.1% to $411.99 per share. This might have investors contemplating their next move.

Via StockStory · February 3, 2026

Gaming and hospitality company Boyd Gaming (NYSE:BYD) will be reporting results this Thursday after market hours. Here’s what investors should know.

Via StockStory · February 3, 2026

Exercise equipment company Peloton (NASDAQ:PTON) will be reporting earnings this Thursday morning. Here’s what to look for.

Via StockStory · February 3, 2026

RFID manufacturer Impinj (NASDAQ:PI) will be announcing earnings results this Thursday after the bell. Here’s what you need to know.

Via StockStory · February 3, 2026

Medical professional network Doximity (NYSE:DOCS) will be reporting earnings this Thursday after the bell. Here’s what to look for.

Via StockStory · February 3, 2026

Global life reinsurance provider Reinsurance Group of America (NYSE:RGA) will be reporting earnings this Thursday after market hours. Here’s what investors should know.

Via StockStory · February 3, 2026

Semiconductor production equipment provider Amtech Systems (NASDAQ:ASYS) will be reporting results this Thursday afternoon. Here’s what investors should know.

Via StockStory · February 3, 2026

Network chips maker MACOM Technology Solutions (NASDAQ: MTSI)

will be reporting results this Thursday before market open. Here’s what to expect.

Via StockStory · February 3, 2026

Dental products company Envista Holdings (NYSE:NVST)

will be reporting results this Thursday after market close. Here’s what investors should know.

Via StockStory · February 3, 2026

Sport boat manufacturer MasterCraft (NASDAQ:MCFT)

will be reporting earnings this Thursday morning. Here’s what investors should know.

Via StockStory · February 3, 2026

Global music entertainment company Warner Music Group (NASDAQ:WMG) will be announcing earnings results this Thursday after market hours. Here’s what you need to know.

Via StockStory · February 3, 2026

Multi-industry consumer and professional products manufacturer Griffon Corporation (NYSE:GFF)

will be reporting results this Thursday before market open. Here’s what investors should know.

Via StockStory · February 3, 2026

Pet products provider Bark (NYSE:BARK)

will be announcing earnings results this Thursday after market hours. Here’s what to look for.

Via StockStory · February 3, 2026

Precision measurement company Mettler-Toledo (NYSE:MTD)

will be reporting results this Thursday afternoon. Here’s what investors should know.

Via StockStory · February 3, 2026

Data collaboration platform LiveRamp (NYSE:RAMP) will be reporting earnings this Thursday after market hours. Here’s what to expect.

Via StockStory · February 3, 2026

Professional tools and equipment manufacturer Snap-on (NYSE:SNA)

will be reporting earnings this Thursday before market hours. Here’s what investors should know.

Via StockStory · February 3, 2026

Collaboration software company Atlassian (NASDAQ:TEAM) will be announcing earnings results this Thursday afternoon. Here’s what to look for.

Via StockStory · February 3, 2026

Cloud computing and online retail behemoth Amazon (NASDAQ:AMZN)

will be announcing earnings results this Thursday afternoon. Here’s what investors should know.

Via StockStory · February 3, 2026

Global media and publishing company News Corp (NASDAQ:NWSA)

will be announcing earnings results this Thursday after the bell. Here’s what investors should know.

Via StockStory · February 3, 2026

Bearings manufacturer RBC Bearings (NYSE:RBC) will be reporting results this Thursday before market open. Here’s what investors should know.

Via StockStory · February 3, 2026

Private markets investment firm StepStone Group (NASDAQ:STEP) will be reporting earnings this Thursday after the bell. Here’s what to expect.

Via StockStory · February 3, 2026