Shareholders of Triumph Financial would probably like to forget the past six months even happened. The stock dropped 20.7% and now trades at $62.56. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Triumph Financial, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Triumph Financial Not Exciting?

Even though the stock has become cheaper, we're cautious about Triumph Financial. Here are three reasons why there are better opportunities than TFIN and a stock we'd rather own.

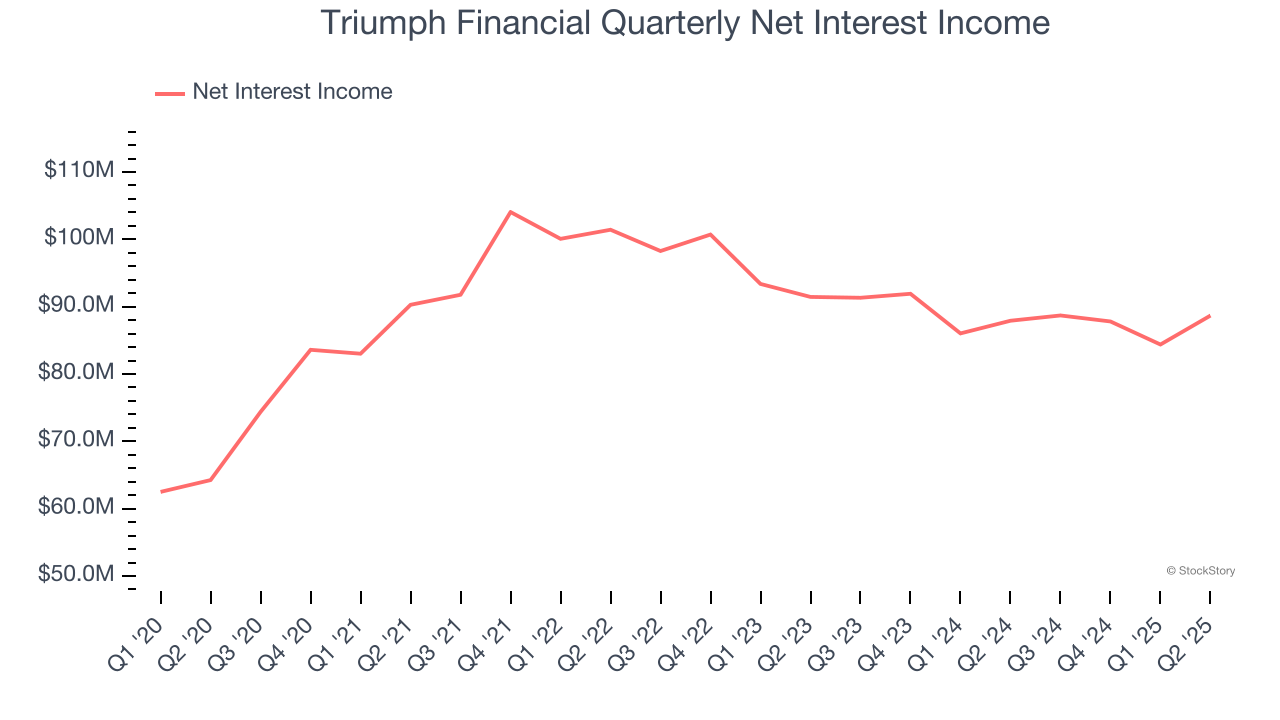

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Triumph Financial’s net interest income has grown at a 6.4% annualized rate over the last five years, slightly worse than the broader bank industry and in line with its total revenue. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

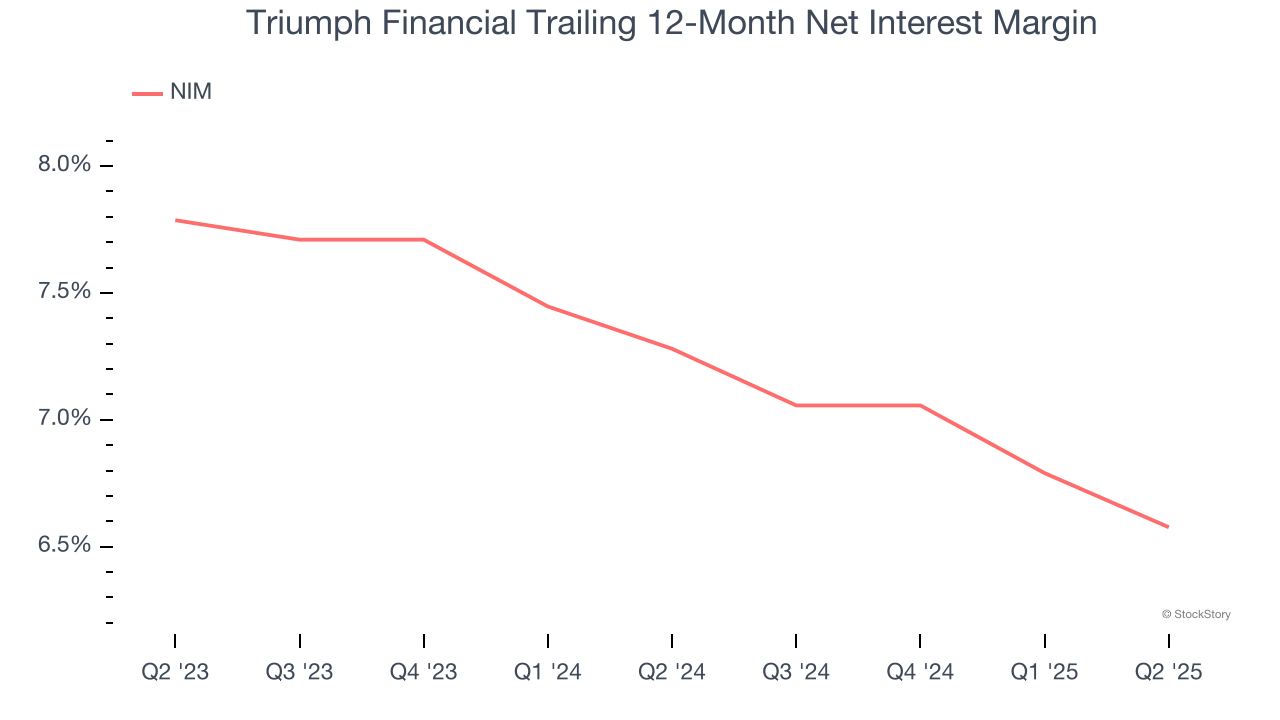

2. Net Interest Margin Dropping

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, Triumph Financial’s net interest margin averaged 6.9%. However, its margin contracted from 7.8% to 6.6% over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Triumph Financial either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

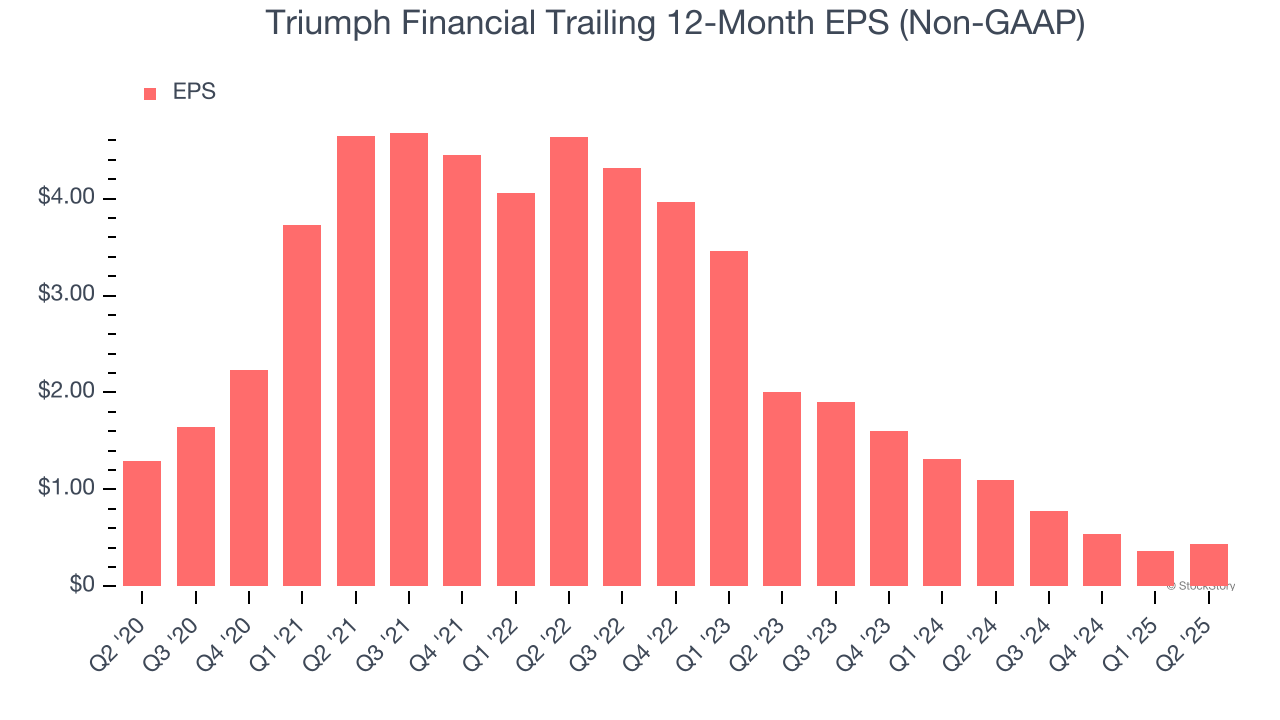

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Triumph Financial, its EPS declined by 19.4% annually over the last five years while its revenue grew by 6.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Triumph Financial isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 1.7× forward P/B (or $62.56 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Triumph Financial

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.