Market-rate apartment occupancy is expected to hold steady as demand remains strong

RealPage®, a leading global provider of AI-driven software platforms to the real estate industry, announced today its 2025 second quarter analysis of the multifamily housing sector and key indicators for the third quarter and beyond. RealPage saw the pace of new apartment supply further decelerate following an ongoing, rapid decline in construction activity.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250722485171/en/

RealPage Second Quarter Analysis Forecasts Continued Strong Apartment Demand

“Demand for apartments has shown remarkable resilience even as the once-in-a-generation supply wave crests and retreats,” said Carl Whitaker, chief economist at RealPage. “We’re observing healthy absorption rates across the nation. While new supply is decelerating, the total volume of new inventory delivering remains enough to satiate demand.”

Q2 Industry Takeaways

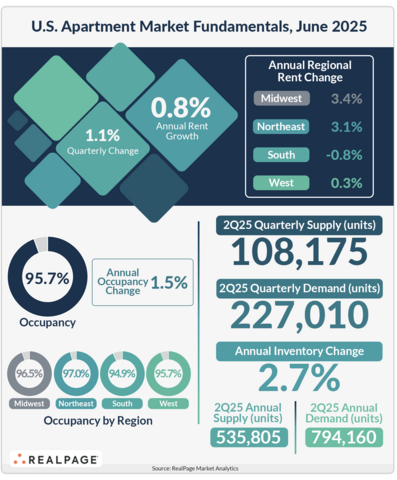

- Occupancy is currently steady at 95.7%, a modest year-over-year increase.

- While average effective rents have grown at a muted rate of 0.8% year-over-year in the second quarter, markets with lower supply volumes, such as the Midwest, are seeing slightly stronger rent growth.

- Concessions remain elevated across most markets, with 20% of the units currently offering a concession with one-month free promotions.

- Rent growth remains strongest in regions with historically low supply volumes, emphasizing the growing disparity between limited vacancy coastal markets and supply-laden Sun Belt areas.

- Rents have declined in 13 states over the past year, led by Arizona and Colorado with drops of over 4%. Both states rank among the top 5 for apartment inventory growth, behind only South Dakota, Idaho and North Carolina.

- The declines in these 13 states aren't due to weak demand. Instead, strong supply appears to be meeting housing needs and may even be fueling economic growth by improving affordability; with job growth in these states averaging 0.7% YoY increase.

"Rents are falling in states where new housing supply has been able to satiate - and even surpass - concurrent demand levels,” added Carl Whitaker, chief economist at RealPage. “This appears to be a real-time, applied example of how new housing supply ultimately helps create a more affordable market for households throughout those local geographies."

Q3 Industry Outlook

- Key regional differences are emerging in the forecast. Coastal markets such as San Francisco and New York are expected to tighten further, with vacancy rates dropping below 4% in 2026.

- The South region, including Dallas and Atlanta, continues to recover as excess supply stabilizes.

- Exceptions exist among the nation’s largest metros. While nine markets, including Los Angeles, Detroit, San Diego, and Newark-Jersey City, are expected to experience an increase in deliveries, seven others, led by San Jose, Minneapolis, and Denver, will witness delivery slowdowns of 60% or more.

Over the past 12 months, U.S. apartment construction has seen a 37% drop, resulting in 320,000 fewer units under construction during that period, compared to the July 2024 tally. The forecast predicts an additional 34% decrease in housing deliveries in the next 12 months, equating to 180,000 fewer units expected to come to market during that period. Occupancy is projected to hold steady as demand remains robust while new supply diminishes, extending through the remainder of 2025 and into 2026.

RealPage will update its forecasts as macro conditions evolve. Please subscribe to the RealPage Analytics newsletter for a weekly dose of apartment market research and trends brought to you by a team of economists and multifamily analysts at https://www.realpage.com/analytics/subscribe/

About RealPage, Inc.

RealPage improves the business of living.

RealPage is the leading global provider of AI-enabled software platforms to the real estate industry. The company offers the multifamily industry’s first agentic AI platform, Lumina AI™ Workforce, with a coordinated network of intelligent AI agents that work across leasing, operations, facilities, finance and resident engagement. By using RealPage solutions for operational excellence in the front office and throughout property operations, many leading property owners, operators and investors gain transparency into asset performance with data insights, enhancing experiences with customized tools and improving efficiencies to generate incremental yield. Founded in 1998 and headquartered in Richardson, Texas, RealPage joined the Thoma Bravo portfolio of market-leading enterprise software firms in 2021 to realize faster growth and innovation to serve more than 24 million rental units from offices in North America, Europe and Asia. In 2024-2025, RealPage has been recognized as: one of America’s Best Employers by Forbes, one of America’s Best Employers for Women by Forbes, one of America’s Greatest Workplaces for Women by Newsweek, one of America’s Greatest Workplaces for Parents and Families by Newsweek, and has been certified as a Great Place to Work™ in India, the Philippines, the UK and the U.S. RealPage’s resident experience platform, LOFT, earned gold in the TITAN Innovation Awards. https://www.realpage.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20250722485171/en/

Contacts

Jennifer Bowcock

Senior Vice President, Communications & Creative

RealPage

Jennifer.bowcock@realpage.com

408-768-8221