Backed by Jupiter’s Gold Standard Climate Science, Institutions Can Now Assess Climate Exposure, Measure Financial Impact, and Quantify Adaptation ROI Anywhere in the World

Jupiter Intelligence, the trusted leader in climate risk analytics, today announced major platform integrations that establish a new standard for investment-grade climate intelligence. The enhanced ClimateScore™ Global platform now empowers institutional investors and financial institutions to move beyond climate risk awareness to drive active resilience planning with quantifiable, ROI-driven insights.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250723646042/en/

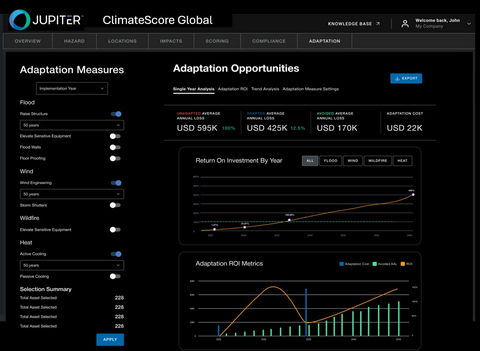

The Jupiter Adaptation Hub is embedded within the enhanced ClimateScore™ Global platform.

As climate change accelerates and intensifies the damage and financial impact caused by severe weather events around the world, the finite number of assets that are resilient enough to remain profitable continues to shrink. This creates pressure to gain competitive advantage on sustainable investments. As such, financial institutions and institutional investors are motivated to quantify climate risk quickly and model their response strategies. While many tools stop at hazard mapping or exposure scores, Jupiter is raising the standard by embedding actionability, ROI, and transparency into every insight.

ClimateScore Global now includes four new capabilities that collectively transform how institutions approach climate resilience:

- Jupiter Adaptation – Quantifies avoided losses and calculates ROI across 10+ adaptation strategies, enabling institutions to move from risk awareness to action with defensible data on adaptation costs, effectiveness, and return on investment.

- Jupiter Entity Modeling – Delivers climate risk insights on a wide variety of entities including securities, funds, corporates, and investment vehicles, providing competitive visibility and strategic advantage.

- Jupiter MetricEngine – Dynamic, scenario-specific model outputs, including custom return periods, exceedance probabilities, daily threshold counts, and loss distributions. Simulate synthetic weather years for crop modeling or assess regional drought and precipitation shifts.

- Subsidence Peril Metric – Models structural risks from soil-moisture fluctuations in clay-rich soils, including a comprehensive damage model that estimates average annual damage based on foundation type and construction materials.

“For nearly a decade Jupiter has provided the world's largest financial institutions and investment managers with the best and most trusted understanding of the risks associated with climate change. Now we are setting new standards for how climate risk informs capital strategy,” said Rich Sorkin, co-founder and CEO, Jupiter Intelligence. “These platform advances ensure that customers have the tools needed to lead their sectors in climate-informed decision-making with the precision and defensibility that investment committees, regulators, and boards now require.”

The new capabilities build on Jupiter's established foundation already trusted by 20% of the world's largest companies, including 50% of the largest lenders in the U.S. and 25% of the largest financial institutions in the world. Jupiter's integrated approach goes beyond point solutions, providing consistent methodology and scientific rigor across exposure assessment, adaptation planning, and entity-level modeling anywhere in the world.

For asset management firms, the platform enables portfolio-wide resilience planning, due diligence screening, and LP reporting with auditable data. Private equity firms can evaluate climate-driven risks pre-acquisition and model adaptation strategies to inform hold-versus-sell decisions. Banks gain dynamic modeling capabilities for stress testing, loan underwriting, and regulatory compliance with frameworks including NGFS and ECB requirements.

Built on Jupiter's ClimateScore Global platform, which covers the entire planet's surface with 22.3 billion locations and more than a petabyte of climate data, these new integrations represent the first solution to unify entity-level modeling, ROI-backed adaptation, and model risk management-grade metrics. This comprehensive approach enables institutions to move seamlessly from risk assessment to strategic action within a single, trusted platform.

For more information and product details, please click here.

About Jupiter

Jupiter is the trusted leader in climate risk analytics for organizations looking to strengthen their climate resilience. The increasing frequency and severity of extreme weather events across the globe are having a major impact on economies, businesses, and communities. Jupiter customers proactively assess the physical risks in their portfolios, address regulatory requirements, and evaluate potential reputational concerns. With forward-focused, rigorous methodologies, and analytics delivered by some of the best scientists in the industry, Jupiter turns sophisticated climate science into actionable data.

To find out more, visit www.jupiterintel.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250723646042/en/

While many tools stop at hazard mapping or exposure scores, Jupiter is raising the standard by embedding actionability, ROI, and transparency into every insight.

Contacts

Media Contact:

Brian Czarny

brian@jupiterintel.com